2022 Mohawk Canada Plans

-

Canada Plans

Your group benefits are provided by Manulife, with the exception of the Retirement Savings Plan, which is administered by Sun Life Financial.

Group benefits continue to be provided by Manulife. For a comprehensive overview of your medical and dental plans through Manulife, click the buttons above.

Please see the benefit summary to the right to review your plan.

Click here to view memo to employees.

Enrolling or Making Changes?

To make changes to current elections or would like to enroll, you may complete one of the forms – see below. Return forms to Denise Garcia.

- Denise Garcia--214-309-4057 or via email

This email address is being protected from spambots. You need JavaScript enabled to view it.

If your are enrolling for the first time, please complete:

If making changes to your current election - adding dependent(s) to current plan:

- Change Enrollment Application

- EOI Form for the person adding

If making changes to your current election - removing dependent(s) from current plan:

- Change Enrollment Application

- EOI Form for the person adding

If you want to increase or add Optional Life please complete:

2022 Rates

With Mohawk benefits, you're covered!

- Extended Health Care (Medical, Prescription Drugs and Dental)

- Basic Life and AD & D

- Dependent Life Insurance

- Optional Life Insurance for Employees and Spouses

- Short-term Disability

- Long-term Disability

- Employee Assistance Program

- Registered Retirement Savings Plan (RRSP)

- Denise Garcia--214-309-4057 or via email

-

Manulife Medical / Vision / Pharmacy

Please see the benefit summary to the right to review your plan.

Extended Health Care Benefit

This benefit has many components that extend your coverage to a wide variety of health care providers and services including drugs, vision, healthcare professionals (professional services), medical supplies and services, hospital, medical and non-medical travel emergencies, health resources, and counselling services. Under the broad category there may be coinsurances, deductibles, maximums and limitations that apply to specific components of the coverage.

This plan will not automatically assume eligibility for all drugs, services and supplies. New drugs, existing drugs with new indications, services and supplies are reviewed by Manulife Financial using the due diligence process. Once this process has been completed, the decision will be made by Manulife Financial to include as a covered expense, include with prior authorization criteria, exclude or apply maximum limits.

Please refer to the Benefits Booklet on the right for plan exclusions and other details.

Benefit Details

- You are eligible for Manulife Basic Extended Health Care Benefit after two months.

- The Maximum is unlimited

- There is no deductible

- Co-insurance - 80% for Hospital Care, Professional Services, Vision, Medical Services & Supplies, Drugs

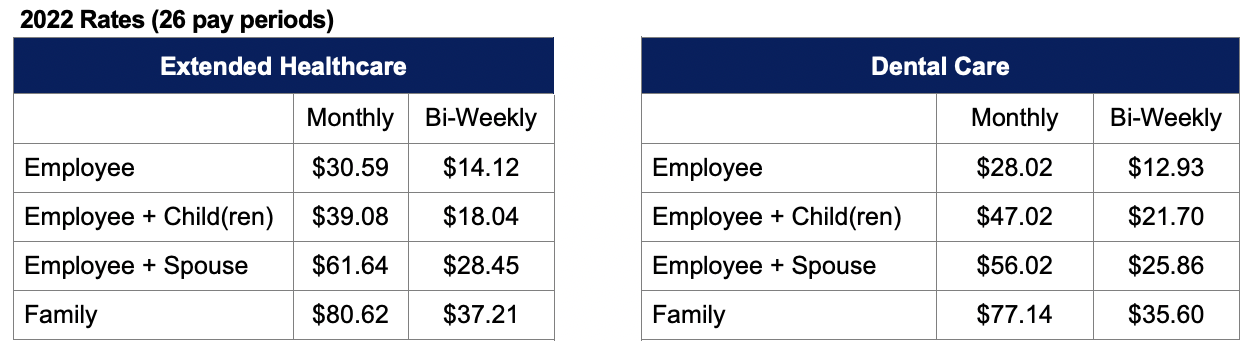

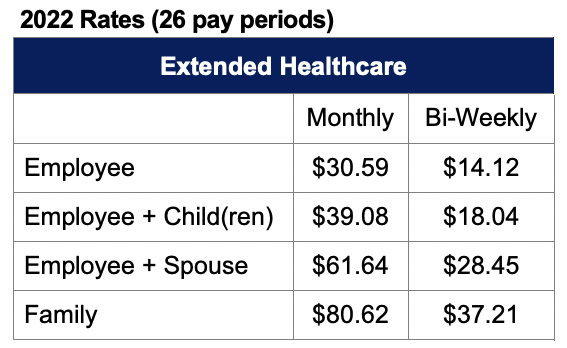

Rates

How Do I Access My Benefits?

There are two ways to access your benefits (View or print your Manulife ID card, find healthcare providers, submit online claims, review your coverage, check drug coverage, access forms and booklets and practical advice and information to help improve or maintain your health with Health eLinks)

Online at www.manulife.ca/planmember - Sign in to My group benefits. Select Register now to get started. Fill in your information and Submit. You’ll need your plan contract and member certificate number on your benefits card. - OR -

On the go with the Manulife App - available for Apple and Android - submit claims, use your benefits card, look up medication details with lower-cost options, find health care providers near you and more.

Register for direct deposit of benefit reimbursements and electronic delivery of claims statements. These options speed processing and reimbursement. You must be registered for both services to have providers’ electronic submissions processed through Provider e-Claims.

Your Manulife Policy/Contract number is 633399.

Additional Information and Questions

To enroll or make changes to your benefits, contact Denise Garcia by email -

This email address is being protected from spambots. You need JavaScript enabled to view it. Manulife customer service support - 1-800-268-6195. Your Manulife Policy number is 633399.

- English: 8am to 8pm Monday through Friday EST

- French: 8am to 5pm Monday through Friday EST

www.manulife.ca/planmember (Registration is required).

-

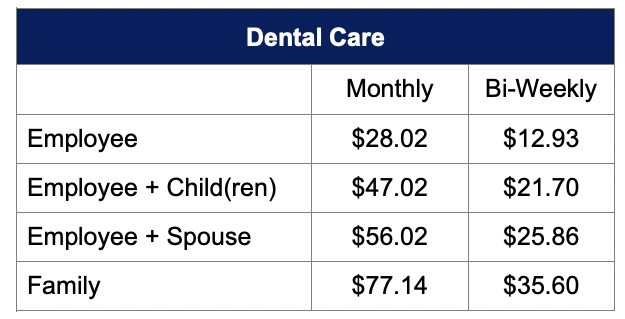

Manulife Dental

As part of your benefit offerings through Manulife, we offer dental insurance for you and your family. Dental plan rates will increase for 2021. Please note, you must enroll in medical insurance to enroll in dental insurance.

Benefit Information

- For plan information, please refer to the Summary located on the top right of this page.

- If you apply for coverage for Dental insurance late, Late Dental Application insurance will be limited to $125 for each insured person for the first 12 months of coverage.

- If you anticipate charges for any treatment to exceed $500, please submit a pre-treatment plan before receiving the service so you can understand what portion your plan may cover.

Maximums

- Level I services maximum - $1,500 per calendar year

- Level II, Level III, Level IV combined maximum - $1,500 per calendar year

- Level V maximum - $1,500 per lifetime

Rates

How Do I Access My Benefits?

There are two ways to access your benefits (View or print your Manulife ID card, find healthcare providers, submit online claims, review your coverage, check drug coverage, access forms and booklets and practical advice and information to help improve or maintain your health with Health eLinks)

Online at www.manulife.ca/planmember - Sign in to My group benefits. Select Register now to get started. Fill in your information and Submit. You’ll need your plan contract and member certificate number on your benefits card. - OR -

On the go with the Manulife App - available for Apple and Android - submit claims, use your benefits card, look up medication details with lower-cost options, find health care providers near you and more.

Register for direct deposit of benefit reimbursements and electronic delivery of claims statements. These options speed processing and reimbursement. You must be registered for both services to have providers’ electronic submissions processed through Provider e-Claims.

Your Manulife Policy/Contract number is 633399.

Additional Information and Questions

To enroll or make changes to your benefits, contact Denise Garcia by email -

This email address is being protected from spambots. You need JavaScript enabled to view it. Manulife customer service support - 1-800-268-6195. Your Manulife Policy number is 633399.

- English: 8am to 8pm Monday through Friday EST

- French: 8am to 5pm Monday through Friday EST

www.manulife.ca/planmember (Registration is required).

-

RBC Insurance Basic Life & AD&D

Employees are provided Basic Life & AD&D coverage and dependent life coverage after two months of employment at no cost. In the case of death, 100% of the benefit is payable to your beneficiary. AD&D Insurance pays benefits in the event of death or dismemberment due to an accident. For loss of life, paralysis, loss of limbs, sight, speech or hearing, you or your beneficiaries will receive an amount equal to or a portion of your full AD&D benefit, depending on the extent of the loss.

Employee Basic Life and AD&D

- You are eligible for RBC Basic Life & AD&D after two months.

- The qualifying period for waiver of premium is 91 days.

- Benefit amount is 1 times your annual earnings, to a maximum of $750,000

- Non-evidence of insurability, benefit limit amount is $450,000

Dependent Life

- You are eligible for RBC Dependent Life after two months.

- The benefit amount is $10,000 for your spouse and $5,000 for each dependant child.

- Spouse and or children are eligible for this benefit regardless if they are enrolled in the Extended health or not.

_________________________________________________________________________________________________________

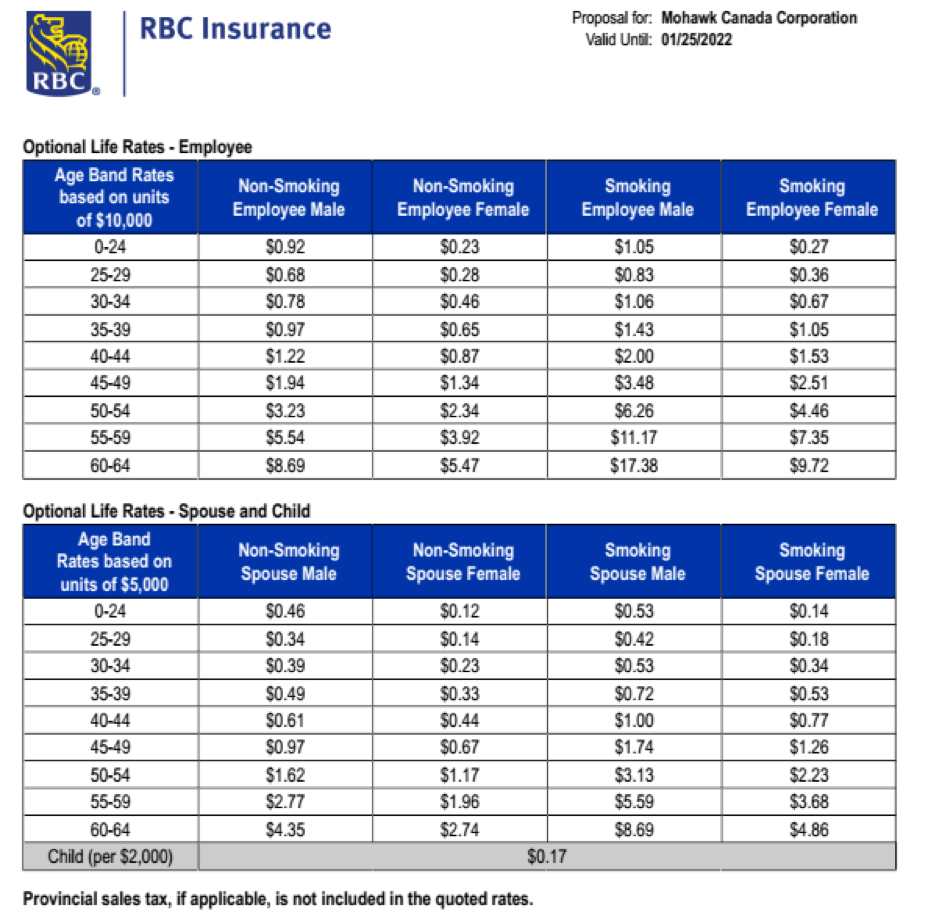

Optional Life Coverage

You may also wish to consider supplementing this coverage by purchasing Optional Life.

Coverage for You, Your Spouse and Child(ren)

- You are eligible for RBC Optional Life insurance after two months.

- Employee Optional Life - You may purchase coverage in increments of $10,000 to a maximum of $250,000

- Spouse Optional Life - You may purchase coverage in increments of $5,000 to a maximum of $250,000

- Dependent Child(ren) - You may purchase coverage in increments of $2,000 to a maximum of $10,000

- All amounts are subject to Evidence of Insurability.

- Rates are based on age, gender, smoking status and are medically underwritten.

- Qualifying Period for Waiver of Premium - 91 days

Rates

_______________________________________________________________________________________________________________________________________________________

Enrolling in Optional Life

Evidence of Insurability (EOI) requires completion only if you wish to participate in Optional Life for you and your spouse.

Evidence of Insurability (EOI) Form

You may return your completed forms via email or you may do so by mail at the address below.

- Denise Garcia--214-309-4057 or via email

This email address is being protected from spambots. You need JavaScript enabled to view it.

Dal-Tile

Attn: Denise Garcia

7834 C.F. Hawn Freeway

Dallas, Texas 75217_______________________________________________________________________________________________________________________________________________________

Filing a Claim

Your beneficiary or estate must submit a claim within 90 days of the date of death. He or she can obtain the necessary paperwork from your plan sponsor. Claims for Waiver of Premium must be submitted within 180 days of the end of the qualifying period.

Additional Information and Questions

To enroll or make changes to your benefits, contact:

- Denise Garcia--214-309-4057 or via email

This email address is being protected from spambots. You need JavaScript enabled to view it.

Please refer to the Benefits Booklet on the right for plan exclusions and other details.

RBC customer service support - 1-855-264-2174. Your RBC Policy number is RBC00002605.

www.rbcinsurance.com (Registration is required).

- You are eligible for RBC Basic Life & AD&D after two months.

-

RBC Insurance Disability

Short-Term Disability

Employees are provided Short-Term Disability coverage at no cost. This benefit provides income protection if you become unable to work due to non-work-related illness, accident and hospitalization, if your disability claim is approved.

- You are eligible for Short-Term Disability after two months.

- Disability benefits begin on the eighth day of the illness.

- For accidents and hospitalization, there is no waiting period before benefits are payable.

- The maximum benefit period is 17 weeks (119 days).

- The benefit amount is 70% of your weekly earnings, to a maximum of $1,200.

______________________________________________________

Long-Term Disability

Employees are also provided Long-term Disability (LTD) coverage at no cost. LTD provides you with partial income replacement due to non-work-related illness or injury, for an extended period of time in the event your disability lasts longer than 17 weeks (119 days).

- You are eligible for Long-term Disability after two months.

- There is a 17 weeks (119 days) waiting period before Long-term disability benefits are payable.

- The maximum benefit period is to age 65.

- The benefit amount is 70% of your monthly earnings, to a maximum of $9,000.

- Evidence of Insurability is required for coverage of $8,200 and above.

For Additional Information

To enroll or make changes to your benefits, contact:

- Denise Garcia--214-309-4057 or via email

This email address is being protected from spambots. You need JavaScript enabled to view it.

For additional plan details, refer to the Group Life/Disability Benefits Booklet on the right or call RBC customer service at 1-855-264-2174. Your RBC Policy number is RBC00002605.

- You are eligible for Short-Term Disability after two months.

-

Employee Assistance Program (EAP) through RBC Insurance

Our full-service Employee Assistance Program (EAP)... offers support to help businesses and employees thrive. The program offers unlimited access to short-term counselling to help employees, and their eligible family members, cope with a broad range of issues from psychological problems to addictions, or family and marital concerns.

Connect to better health and well-being – Immediate, free confidential help for any concern, 24 hours a day – 7 days a week.

Your EAP Helps you

- Achieve Personal Well-Being

- Get Legal Clarity

- Research Child/Elder Care Resources

- Tackle Addictions

- Get Health Advice

- Manage Relationships and Family

- Get Financial Clarity

- Address Workplace Challenges

- Understand Nutrition

For additional information see brochure.

Get the support you need, the way you choose

By telephone

Call us anytime, 24 hours, 7 days a week, knowing it’s completely confidential. An expert will get to know your needs and direct you to the best and most appropriate resources.

English: 1-877-630-6701 | French: 1-877-588-1299 | TTY/TDD: 1-877-371-9978

By live webcam or in personAccess face-to-face counselling by video or in person.

By visiting our website or appAccess articles, educational materials, toolkits, podcasts and so much more.

Visit lifebalance.net or launch the LifeWorks application, enter your user ID and password:

English Username rbceng

English Password: rbceng

French Username: rbcf

French Password: rbcf -

Sun Life Financial Registered Retirement Savings Plan (RRSP)

Joining the Retirement Savings Plan, administered by Sun Life Financial, is one of the best ways to save for retirement!

You’ll need a source of income after you’re no longer working. To help you build a more secure future, the Company sponsors the Mohawk Canada Corp Registered Retirement Savings Plan. Your future's bright because we offer a great plan.

- Benefit from Mohawk's matching contribution... which helps you accumulate money into your retirement account.

- Mohawk will match 50% of the first 6% of your wages that you contribute.

- A convenient, easy way to save for your future through payroll deduction.

- Save on your current income taxes...while you save for retirement.

- Help build security for retirement...and have the potential to grow your money over time

Eligibility

You are eligible to participate in the RRSP and receive the Company match on your contribution effective the first day of full time employment! You may join at any time after you become eligible. Participation is voluntary.

Review Sun Life Financial "My Money" - English| French to learn more information about your RRSP program. If you would like a copy of the RRSP plan description please Click - English / French.

Enrolling

To start saving for you future, you need to enroll in the plan. Complete the RRSP Retirement Savings Plan enrollment form to get started today! - Click - English | French.

Submit the completed form to Denise Garcia via email:This email address is being protected from spambots. You need JavaScript enabled to view it. .Your investment options

You make the investment decisions for all contributions to the plan. The investment choices available to you are described in detail in your investment and savings guide. You can change your investment direction for future contributions, or transfer amounts between funds at any time, by accessing your account online at www.mysunlife.ca, by calling Sun Life Financial‟s Customer Care Centre at 1-866-733-8613 or by completing a financial change form obtained from the Customer Care Centre.

If you do not make an investment choice, or the total percentage does not equal 100%, the total/difference, as the case may be, will be invested in a Sun Life Financial Milestone® Segregated Fund. This default fund is subject to change in the future.Limits on Contributions

Please refer to plan documentation to ensure you are meeting the guidlines of the Income Tax Act (Canada).

Your Money Goes with You

100% of the money you put into your 401(k) account is yours to take if you leave Mohawk. After one year of participation in the plan, 100% of the funds contributed by Mohawk are also yours to take if you leave. In financial terms, this means you are 100% vested in your personal contributions immediately and 100% vested in Mohawk’s contributions after one year.

Have Questions?

To enroll or make changes to your benefits, contact:

- Denise Garcia--214-309-4057 or via email

This email address is being protected from spambots. You need JavaScript enabled to view it.

Contact Sun Life Financial at 1-866-733-8613.

1-800-268-6195

1-866-733-8613

English: 1-877-630-6701

French: 1-877-588-1299