2025 Open

2025 Open

Enrollment Home

2025 Benefits Open Enrollment is

October 28 - November 8, 2024

Open Enrollment is your annual opportunity to enroll in health, dental, vision, accident and critical illness coverage or make changes to the coverage you already have.

Our 2025 Open Enrollment period is Oct. 28 - Nov. 8, 2024.

Some benefits are company-paid, such as basic life insurance, accident, death and dismemberment (AD&D) insurance, and short-term disability. It’s also the time to set aside pretax money for your eligible medical expenses with the health savings account (HSA) or healthcare flexible spending account (FSA).

Eligibility

Full-time or part-time employees scheduled to work 30 hours or more per week are eligible for Mohawk benefits the 1st of the month following 60 days of employment for all plans. You may also cover your eligible dependents (spouse and/or children) for certain benefits including medical, dental, vision and more. You will be asked to verify your dependents’ eligibility through BenefitFocus at the time of your enrollment. Click to learn more about eligibility.

Enrolling

We offer two easy, convenient ways to enroll in your benefits, online through Employee Central or by calling our Benefits Service Center weekdays from 8 a.m.–8 p.m. ET during Open Enrollment, except for Friday, Nov. 8, 2024 when Open Enrollment closes at 6 p.m. ET.

![]()

Important Reminders About Open Enrollment

- If you choose not to take action, your existing coverage options will roll over into 2025, with the exception of healthcare or dependent care flexible spending accounts (FSAs). You must re-enroll in healthcare or dependent care flexible spending accounts each year.*

- Employees enrolled in the Copay Plan, employees age 65 and older and employees not enrolled in a high deductible health plan may participate in the FSA. You can enroll in the healthcare FSA even if you DO NOT enroll in Mohawk’s healthcare coverage.

- Make sure you have the names, Social Security numbers and dates of birth for you and your dependents.

- If you enroll a spouse in the Company Medical Plan, they will be included in a spousal audit for other medical coverage.

- If your spouse’s company offers insurance and you elect to cover them on Mohawk’s Medical Plan, you will pay an additional $125 per month in medical contributions.

*Please note, per IRS guidelines, you are not eligible to enroll in the healthcare FSA if you are enrolled in the health savings account (HSA). You may contribute the maximum amount allowed by the IRS.

|

Click the "Benefits 2025" menu at the top or above right for all 2025 plan details. |

New for 2025

New Benefits Open Enrollment Portal

We are excited to launch a new and improved enrollment portal for 2025 Open Enrollment. Employees may visit Employee Central and select the open enrollment tile to be taken to the new portal, or contact the Benefits Service Center at 1-866-481-4922 for assistance with enrollment. The new portal offers a clear, concise view of your benefits coverage, personalizes the enrollment experience and is mobile friendly! Click here for more information on how to complete Open Enrollment.

Introducing Capital Rx

We are pleased to announce a new partnership with Capital Rx as our preferred pharmacy vendor. Capital Rx is a next generation pharmacy benefit manager, ensuring affordable medicine and better support for your prescription needs. Capital Rx has relationships with more than 60,000 pharmacies throughout the U.S., including Kroger and Costco.

What's Changing?

You will continue to enjoy the same pharmacy services you have today, including saving time and money with mail order for your 90-day maintenance medications. Current prescriptions with Express Scripts will automatically transfer to Capital Rx. For more information on Capital Rx, see below.

LTD Age Bands

Long-term disability (LTD) insurance is moving to 5-year age bands. This aligns with our other benefit offerings such as life insurance and critical illness insurance. Remember, LTD provides you with partial income replacement for an extended period of time in the event your disability lasts longer than 90 days. For more information, visit the LTD page.

![]()

Medical & Prescriptions

Comparing the HSA and Copay Plans

Mohawk employees have the choice of two medical plans administered through Cigna, the HSA plan and the Copay plan. As you consider which plan is right for you and your family, it’s important to understand how the HSA and Copay plans compare. Both the HSA and Copay plans cover the same services and medications, and provide access to the same great network of providers.

See HSA and Copay plan comparison below for details.

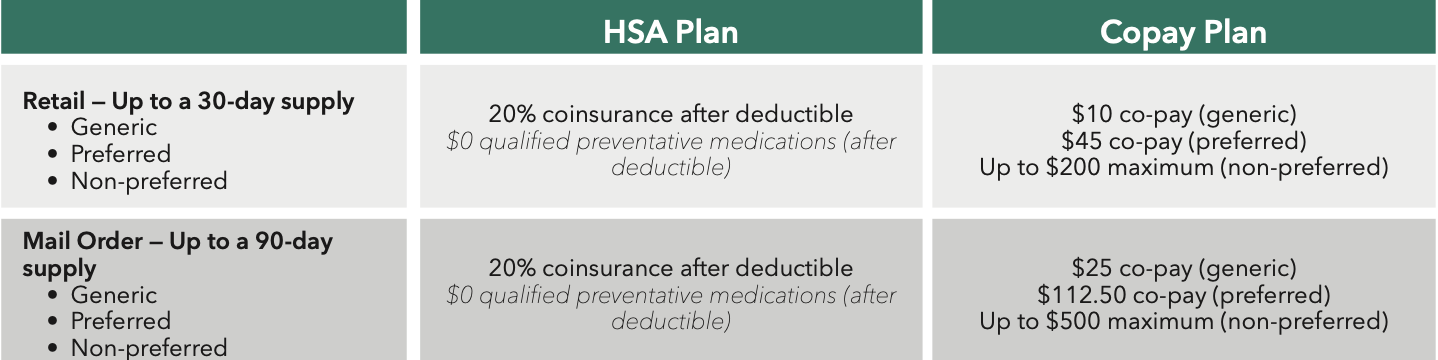

Pharmacy

When you enroll in a Mohawk medical plan, you automatically receive prescription drug coverage. What you pay for prescription drugs depends on your medical plan selection, the type of medication (specialty vs. preventive, brand name vs. generic, etc.), and where your prescription is filled. Certain preventive drugs are available at no cost to you! Click for the full list of preventive medications.

Benefits for You

Capital RX pharmacy partners include Costco and Kroger. Capital Rx offers a mobile app for you to easily view and manage your benefits and prescriptions. Be on the lookout for a Welcome Packet to arrive in the mail by the end of December. Best of all, you will still have only one combined medical/pharmacy ID card!

2025 Prescription Drug Costs

Anne, I think this chart is the same for both NWGA and OAP. Please confirm.

1. Coverage only applies to in-network providers. There is no coverage for out-of-network providers.

1. Coverage only applies to in-network providers. There is no coverage for out-of-network providers.

2. The third time you purchase certain long-term maintenance drugs at a participating retail pharmacy, you will pay more unless you order through Capital RX

3. VIVIO is Mohawk’s partner for specialty medication prescriptions through Walmart Specialty Pharmacy, HealthWarehouse, and others. If you have a question about how VIVIO and specialty medications, please contact the VIVIO Concierge by phone at 800-470-4034.

Brand-Name Diabetic Medication

For 2025, brand-name diabetic medications (link to PDF) have a $50 copay per 30-day supply, excluding test strips, for all plans. Remember, generic versions are still available at no cost! You’ll generally pay less for generics than for brand name drugs. Talk with your doctor about whether there’s a lower-cost option for your medication.

Want more Pharmacy information?

Other 2025 Benefit Highlights

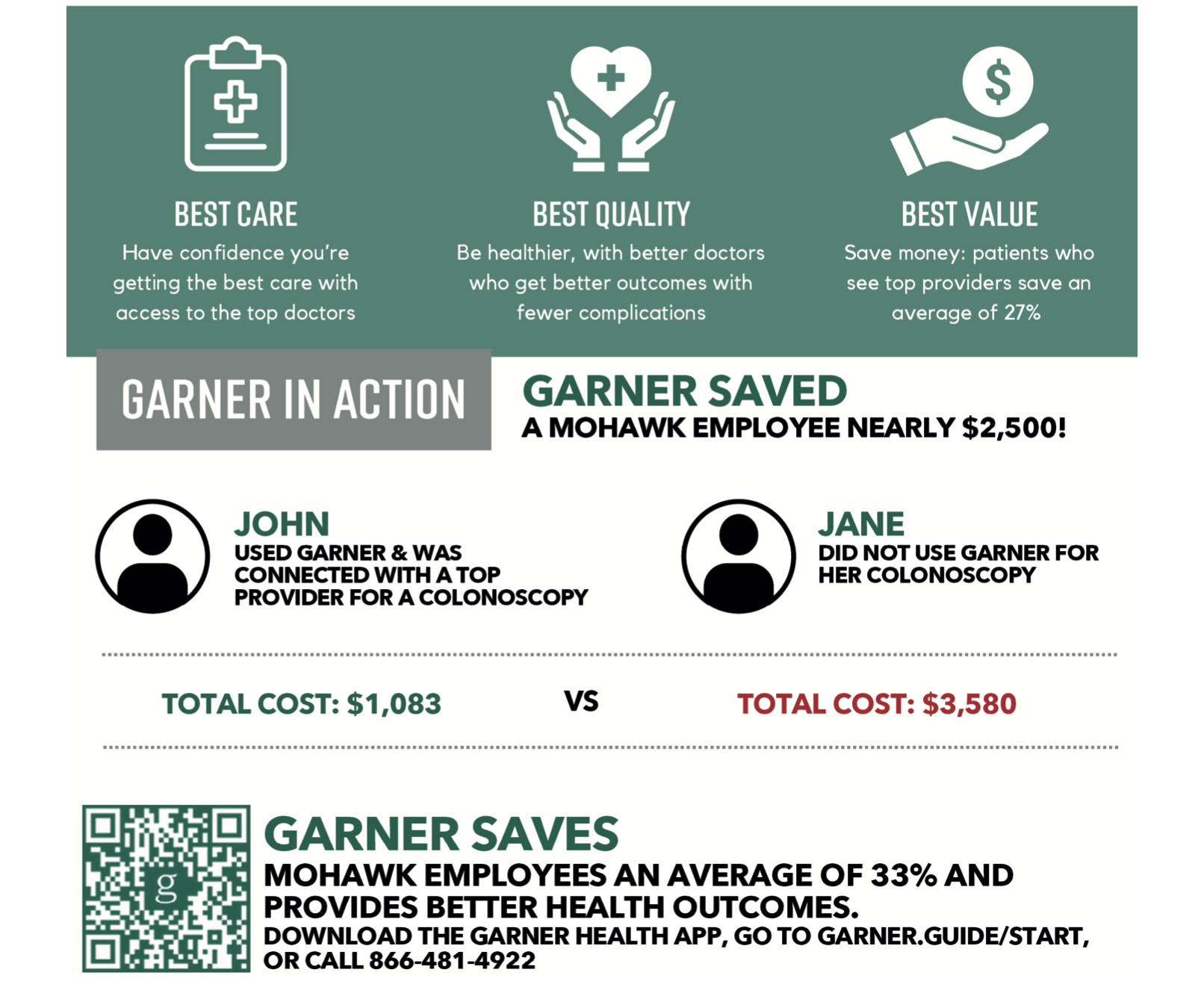

Garner- No Cost Health Plan Tool and Service

Mohawk has partnered with Garner - giving you the power to compare doctors, hospitals and testing facilities with up-to-date “insider information” from insurance and government sources, so you get the Best Care, Best Quality & Best Value!

Garner will show you the top local options that meet your needs, taking the fear out of choosing the wrong doctor or hospital and eliminating the risk of being overcharged. You save 25, 30, 40% or more on procedures! The Garner app is fast and easy to use (Just scan the QR code below). We’ve also arranged free personalized phone support as well.

![]()

Zip Code Search

Use the ZIP code search feature below to see which plan(s) you're eligible for in 2025.

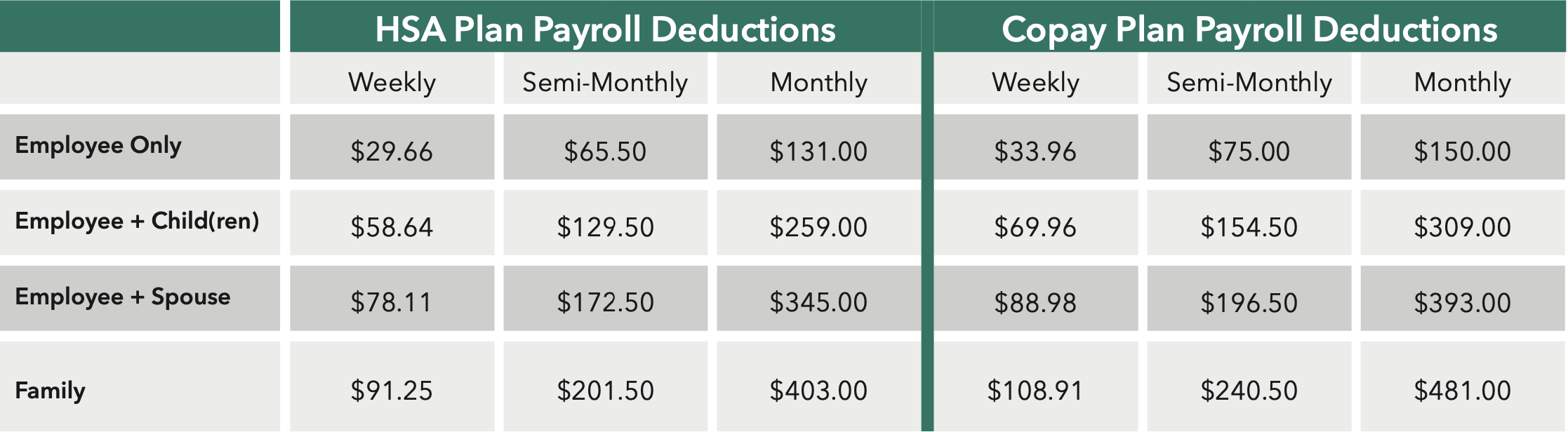

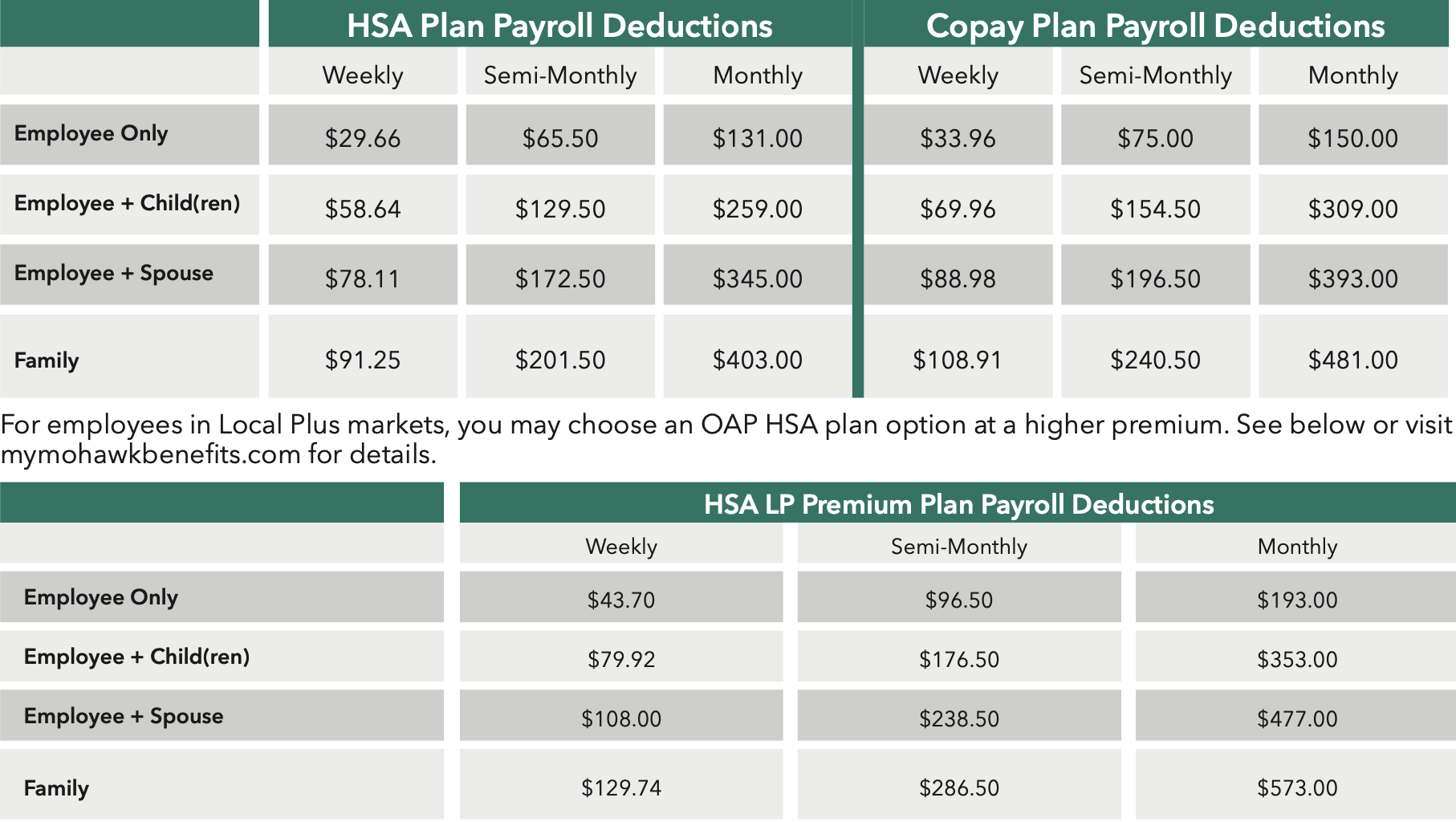

2025 Medical Rates

NW Georgia Plan

OAP Plans

Mohawk contributions to your HSA vary depending on your dependent coverage. If you are only covering yourself, you’re eligible to receive up to $500 of company match. If you are covering yourself and your spouse or child(ren), you are eligible to receive up to $800. If you cover your family, the possible match is also $800. You receive 50% of the company funding in January. The company will match the additional 50% dollar-for-dollar as you contribute. HSA funds are immediately vested and unused funds roll over year-to-year. New hires may contribute to their HSA once they become benefit eligible. However, the employee will not receive any Company money during the first calendar year of participation. The federal contribution limit (including employer contribution) is Single: $4,150; Family: $8,300. If you are age 55+, you may contribute an additional annual catch-up contribution of $1,000.

Medical Plan Surcharges

New enrollees to the company medical plan will be required to complete a biometric screening within 60 days of your benefit effective date to avoid a wellness surcharge. For additional details, visit the Biometrics and Health Coaching page.

Based on results, employees and/or covered spouses may be required to complete face-to-face, telephonic or online health coaching. Employees and covered spouses who choose not to work with a Healthy Life Team Navigator (HLN), do not make contact with their HLN or do not complete biometrics testing, will be charged an additional $28.85 per week or $125 per month as a surcharge on top of your medical plan premium.

If you enroll a spouse in the Company Medical Plan, they will be included in a spousal audit for other medical coverage. If your spouse’s employer offers insurance and you elect to cover him/her on Mohawk’s Medical Plan, you will pay an additional $125 per month in medical contributions.

*New hires and those new to the medical plan as a result of a Qualifying Life Event, please visit the Biometrics and Health Coaching page for details.

![]()

Other Benefits Available to You

As a Mohawk employee, you are eligible for a slate of additional benefits and employee discounts that can help you save money. They include:

|

|

|

|||||

|

|

|

|||||

|

|

|

![]()

Questions?

If you have questions about your benefits or enrolling, call the Benefits Service Center and speak with a Benefits Specialist at 1-866-481-4922.

Our 2025 Open Enrollment period is Oct. 28 - Nov. 8, 2024.

- Before Open Enrollment begins: Monday - Thursday from 8 am - 6 pm ET, Friday from 8 am - 5 pm ET.

- During the Enrollment period: Monday - Friday from 8 am - 8 pm ET - except Friday, November 8th when Open Enrollment closes at 6 pm ET.