2022 Choice Local Plus & OAP HSA

All plans are offered through Cigna and provide care through the same network of doctors, hospitals, laboratories and other providers. The key to saving money and choosing the best plan for you and your family is to understand how the plans work and become an informed healthcare consumer. Make the most of your coverage and savings opportunities.

Take advantage of preventive care benefits--most are no cost for eligible services with in-network providers. Preventive care helps you stay healthy and can catch potential issues early. Covered care includes an annual physical, well-woman exam, immunizations, and other preventive screenings and lab work.

By using in-network providers, our onsite clinics and Amwell telehealth for acute care, mail-order prescription services, participating in pilot programs and limiting visits to the emergency room to true emergencies, you can be a savvy shopper for both quality care and lower cost. Make the most of your coverage and savings opportunities.

![]()

Cigna Local Plus Plan

The Local Plus Plan continues to be the medical plan for employees living in the following areas:

Arizona – Phoenix | California – Bay area and Los Angeles area | Colorado – Denver | Florida – Orlando, Tampa, South Florida (Miami metro area) | Illinois – Chicago | Kansas – Wichita | Massachusetts – Statewide | Nevada – Las Vegas | Rhode Island – Statewide | South Carolina – Greenville/Spartanburg | Texas – Austin, Dallas/Fort Worth, and Houston.

Open Access Plus (OAP) | CIGNA OAP

Employees living outside the northwest Georgia and Local Plus markets remain part of the Cigna Open Access Plus (OAP) plan. For employees in Local Plus markets, you may choose an OAP option at a higher premium. To find a provider or hospital, visit cigna.com. When planning for your health care costs and Health Savings Account (HSA) contributions for 2022, remember in-network and out-of-network deductibles and out-of-pocket expenses are all separate and do not crossover. This plan does not apply to employees working in Hawaii; they remain on the HMSA plan.

Your Healthy Life Care Teams

Our Healthy Life Centers continue to expand services to offer innovative ways to connect with all members of the Company health plan. We recently introduced Care Teams—each employee and their dependents have a special team of dedicated professionals ready to help you. Your Healthy Life Care Team may reach out to you and your dependents periodically throughout the year or you can reach out to them via

Pharmacy

Pharmacy is included when you elect medical coverage. Express Scripts remains our pharmacy vendor. The formulary with Express Scripts can change yearly. To avoid paying full price, please review the 2022 Preferred Formulary and Formulary Exclusion List.

Mycigna.com and myCigna app

Do you have your account set up at mycigna.com? If not, register today to access many resources available from Cigna as a Mohawk health plan member. Need a copy of our health plan ID card? Go to mycigna.com to print a copy or take a photo. You can also see a list of your claims and the status. Looking for an in-network provider? You can find a complete list at mycigna.com, as well as cost estimates for various procedures. Don’t forget that you can review your health savings account (HSA) information, including balance, contributions, and withdrawals.

Already have an account? Log in and see what is new!

myCigna app

The myCigna app is an excellent on-the-go resource. Through the myCigna app, you have access to your health information. Get easy access for your ID card, claims, HSA account balance, provider search, and more. Get now at the Apple App Store, Google Play Store, and Amazon App Store.

Zip Code Search

Zip Code Search

Use the ZIP code search feature below to see which plan(s) you're eligible for in 2022.

Plan Overview

- NO REFERRALS - Choose the doctors you want to see – no referral required to see a specialist.

- DEDUCTIBLE -You pay 100% of your health care expenses until you meet your annual deductible. This includes physician office visits and prescription drugs. See deductible amounts below.

- COST SHARING - After meeting your annual deductible, you share the cost of health care expenses by paying co-insurance (a percentage of the total office visit cost).

- PREVENTIVE CARE - In-network routine preventive care and qualifying preventive prescriptions are covered at 100%.

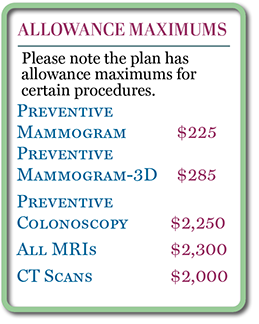

- ALLOWANCE MAXIMUMS - Note that there are allowance maximums for preventive mammogram ($225), preventive mammogram-3D ($285), preventive colonoscopies ($2,250), all MRIs ($2,300 after deductible is met), and CT Scans ($2,000 after deductible is met). See details.

- OUT-OF-POCKET MAXIMUM ALLOWANCE - The most a plan member will pay per year for covered health expenses before the plan pays 100% of covered health expenses for the rest of that year.

> In-Network - Employee Only - $5,000; Family - $13,000

>Out of Network - Employee Only - none; Family - none - PRESCRIPTION - Qualifying Walmart prescriptions ($4 List) are covered at 100% after meeting your deductible.

- MEDICARE - If you are covered under Medicare, you are eligible to participate in the Company Medical Plan, however, you are not eligible to own an HSA Account per IRS guidelines.

- HSA ELIGIBILITY - Per IRS rules, you must be enrolled in the Company's Medical Plan to have an HSA account; have no other health coverage; not be enrolled in Medicare; and cannot be claimed as a dependent on someone else's tax return.

![]()

Medical Plan Details

Click on the plan(s) below that applies to you for details.

|

|

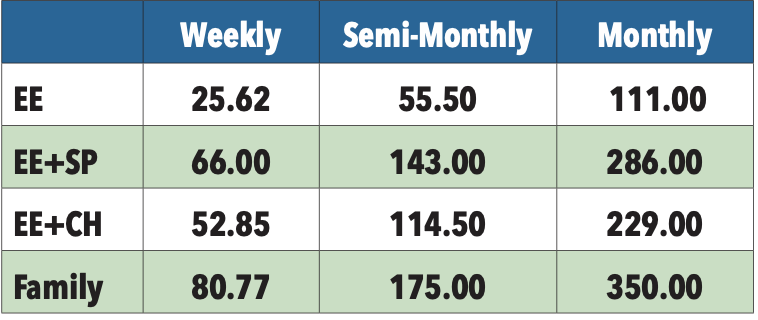

Medical Plan Rates

Cigna LocalPlus Plan & OAP Plan

Cigna LocalPlus Plan & OAP Plan

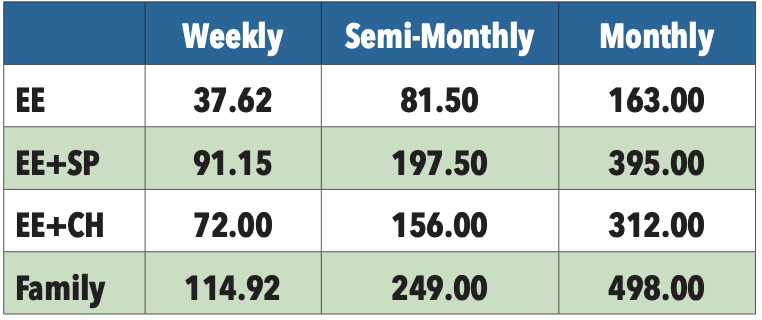

Cigna Premium LocalPlus Plan

Cigna Premium LocalPlus Plan

*For coverage, Spouse also refers to Common Law

![]() Premium Assistance Under Medicaid and the Children’s Health Insurance Program (CHIP)

Premium Assistance Under Medicaid and the Children’s Health Insurance Program (CHIP)

Medical Plan Surcharges

New enrollees to the company medical plan will be required to complete a biometric screening within 60 days of your benefit effective date to avoid a wellness surcharge. For additional details, visit the Biometrics and Health Coaching page.

Based on results, employees and/or covered spouses may be required to complete face-to-face, telephonic or online health coaching. Employees and covered spouses who choose not to work with a Healthy Life Team Navigator (HLN), do not make contact with their HLN or do not complete biometrics testing, will be charged an additional $28.85 per week or $125 per month as a surcharge on top of your medical plan premium.

If you enroll a spouse in the Company Medical Plan, they will be included in a spousal audit for other medical coverage. If your spouse’s employer offers insurance and you elect to cover him/her on Mohawk’s Medical Plan, you will pay an additional $125 per month in medical contributions.

*New hires and those new to the medical plan as a result of a Qualifying Life Event, please visit the Biometrics & Coaching page for details.

Surcharges:

The information below outlines ways in which medical surcharges will be applied. Keep in mind, the maximum surcharge is $57.70 per week or $250 per month in addition to your Medical plan contribution.

- $28.85/wk or $125/mo: If covered Employee does not complete a Biometric Screening when notified.

- $28.85/wk or $125/mo: If covered Spouse* does not complete a Biometric Screening when notified.

- $28.85/wk or $125/mo: If covered Employee requires Coaching based on biometric screening results and refuses to work with a health coach.

- $28.85/wk or $125/mo: If covered Spouse* requires Coaching based on biometric screening results and refuses to work with a health coach.

- $28.85/wk or $125/mo: If Spouse* enrolls in the Mohawk Medical plan and has access to other group medical coverage through their employer.

*For coverage, Spouse also refers to Common Law

How the Medical Plan and HSA Work

|

|

- Elect the Health Savings Account (HSA) during the medical enrollment process.

- You can contribute pre-tax dollars to a Health Savings Account (HSA).

- In order to receive the Company's HSA contribution, you must contribute to your account, up to the current 2022 federal limit (See “HSA Contributions” section below).

- It’s your choice how and when to use the money – use it to pay for your qualified medical, dental, or vision expenses, or save it for future needs.

- The HSA dollars you use go toward paying your annual deductible.

- Whatever you don’t use in 2022 earns interest and rolls over to 2023.

|

|

- With the plan, you’ll pay an annual deductible before your health plan begins to pay for eligible expenses. A deductible is the amount of money that you’ll be required to pay before your plan starts paying benefits.

- You can meet your deductible by using your HSA dollars, your own money or both.

- Only services covered by your health plan count toward your deductible. (See Summary of Benefits below for more details.)

|

|

- Once you meet your deductible, you pay co-insurance, which is a percentage of your medical cost. The plan pays for the rest.

- Your deductible counts toward your out-of-pocket maximum (the most you’ll pay in a given year for all covered expenses). Once you meet your out-of-pocket maximum (which includes your deductible), your plan pays covered expenses at 100%.

Health Savings Account (HSA)

Contributions

Company contributions* to employee Health Savings Accounts in 2022:

$500 (if you contribute $250 or more) - Employee only

$800 (if you contribute $400 or more) - Employee + Spouse

$800 (if you contribute $400 or more) - Employee + Child(ren)

$1,000 (if you contribute $500 or more) - Employee + Family

- You receive 50% of the Company funding in January. If you contribute equal to or greater than the 50% during 2022, the Company will match the additional 50%.

- The federal contribution limit (including employer contribution) is Single: $3,650; Family: $7,300. If you are age 55+, you may contribute an additional annual catch-up contribution of $1,000.

*New Hires, New HSA participants and Qualifying life event participants, please see section below regarding HSA Company contributions.

New Hires

New hires may contribute to their HSA once they become benefit eligible. However, the employee will not receive any Company money during the first calendar year of participation. In 2023, the employee will then be eligible to receive the initial 2023 Company money and the 2023 employer match (as long as the employee is contributing at the appropriate level to the 2023 HSA plan).

- New Hire Example: John Doe is hired Jan. 28, 2022. He may start contributing to the HSA plan once he is benefit eligible; however, during the 2022 calendar year he will not receive any company seed or match. Starting with his first paycheck in 2023, he will receive the 2023 company seed. As long as the employee is contributing to HSA plan, he will receive a match per the terms of the 2023 HSA plan.

New HSA Participants and Qualifying Life Event Participants

New participants to the HSA in 2022 may contribute to their HSA. However, the employee will not receive any Company money during the first calendar year of participation. In 2023, the employee will then be eligible to receive the initial 2023 Company money and the 2023 employer match (as long as the employee is contributing at the appropriate level to the 2023 HSA plan).

Qualifying Life Events During the Year

If an HSA participant has a qualifying life event during the year and changes their HSA coverage (for example changes their HSA plan contribution from Employee Only to Employee + Spouse), they may continue to contribute and receive appropriate company match, however their initial employer seed money provided in January 2022 will not be modified.

HSA Details

HSA Bank administers your HSA account. Any balance remaining in your HSA rolls over to the next year, and if you leave or retire from the Company, the money in your account goes with you. It is never taxable if it is used for qualified medical expenses at any time in the future.

- Contributions to your HSA are taken out of your paycheck before taxes – so the amount of taxes withheld are reduced.

- You will receive an HSA Debit card which draws money directly from your HSA. Use your debit card to pay for services at the doctor’s office, at your local pharmacy, eyeglass retailer or other locations where you purchase medical-related items or services

- The Company pays for the basic banking fees, and the employee is responsible for any additional fees. Please see attached fee schedule for details.

Things to Know About Your HSA

- To receive the Company's HSA contribution, you must elect the Health Savings account (HSA) during the enrollment process.

- HSA Bank may request additional information from you in accordance with the USA Patriot Act. If you don't submit the requested information by the deadline indicated, your account will be closed. Click here for a sample letter and identification verification form to assist you with this process.

- HSA Bank will mail your HSA debit card to a P.O. Box address however, a physical address is needed to keep the account open.

- If you do not receive your HSA debit card in the mail, please contact HSA Bank.

- Learn how to use the HSA Bank customer website through mycigna.com with easy access to account features and functions.

- See additional HSA resources: HSA User Guide | HSA Brochure | HSA FAQs | HSA Bank Investment Options

- For HSA Debit card disputes, please see HSA Fraud Protection document.

![]()

Additional Links and Information

![]() Choice Local Plus HSA Summary Plan Description

Choice Local Plus HSA Summary Plan Description

![]() Choice OAP HSA Summary Plan Description

Choice OAP HSA Summary Plan Description![]() Choice OAP HSA SBC

Choice OAP HSA SBC

![]() Summary of Material Modification-VIVIO Specialty Medications Program

Summary of Material Modification-VIVIO Specialty Medications Program

![]() Approved Cigna Flu Shot Providers

Approved Cigna Flu Shot Providers

![]() Preventive Health Coverage Guide

Preventive Health Coverage Guide

![]() Eligible and Ineligible Expenses

Eligible and Ineligible Expenses

Contact the Benefits Service Center or CIGNA

For questions about your benefits including claims, eligibility, or to order an ID card contact

Benefits Service Center | 1-866-481-4922 OR

Cigna | 1-855-566-4295 | www.mycigna.com

Important Notes:

- In Ala., Calif., and N.J., contributions are prior to federal taxes but after state income taxes. Employer contribution, earned interest and investment income are all taxable as gross income for state income tax purposes.