2023 My Medical Neighborhood Copay Plan

2023 My Medical Neighborhood Copay Plan

We are pleased to announce the addition of the Copay health plan options for 2023. This option gives you the same high-quality providers as the HSA plan with higher premiums but lower deductibles.

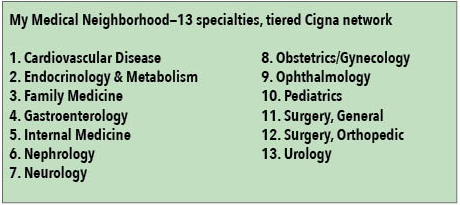

Cigna My Medical Neighborhood remains the health plan for employees in the Muskogee, OK area. The tier structure remains with Tier 2 being My Medical Neighborhood selected providers in the 13 specialties along with all other specialties in the Cigna network. Tier 3 will continue to be providers in the 13 specialties but non-selected providers. And, tier 4 is out-of-network. Remember deductibles do not cross accumulate between tiers.

As always, we encourage you to confirm your doctor(s) are in the Neighborhood for 2023. To find a provider or hospital in the Neighborhood: Visit mymohawkneighborhood.com or call Cigna at 855-566-4295. If you or your dependents seek healthcare outside the Neighborhood area, then Cigna OAP will apply to those healthcare expenses.

Your Healthy Life Care Teams

Our Healthy Life Centers continue to expand services to offer innovative ways to connect with all members of the Company health plan. We recently introduced Care Teams—each employee and their dependents have a special team of dedicated professionals ready to help you. Your Healthy Life Care Team may reach out to you and your dependents periodically throughout the year or you can reach out to them via

Pharmacy

Pharmacy is included when you elect medical coverage. Express Scripts remains our pharmacy vendor. The formulary with Express Scripts can change yearly. To avoid paying full price, please review the 2023 Preferred Formulary and Formulary Exclusion List.

Preventive Care and Other Ways to Save

We believe prevention plays a vital role in health care. To catch problems early, we encourage you to get preventive screenings and annual checkups. Don’t forget—your in-network preventive care is 100% covered! It’s never too late to start your journey to become a healthier you. Your good health is important–to you and your family.

By using in-network providers, our onsite clinics and Amwell telehealth for acute care, mail-order prescription services, participating in pilot programs and limiting visits to the emergency room to true emergencies, you can be a savvy shopper for both quality care and lower cost. Make the most of your coverage and savings opportunities.

Mycigna.com and myCigna app

Do you have your account set up at mycigna.com? If not, register today to access many resources available from Cigna as a Mohawk health plan member. Need a copy of our health plan ID card? Go to mycigna.com to print a copy or take a photo. You can also see a list of your claims and the status. Looking for an in-network provider? You can find a complete list at mycigna.com, as well as cost estimates for various procedures.

Already have an account? Log in and see what is new!

myCigna app

The myCigna app is an excellent on-the-go resource. Through the myCigna app, you have access to your health information. Get easy access for your ID card, claims, provider search, and more. Get now at the Apple App Store, Google Play Store, and Amazon App Store.

Zip Code Search

Use the ZIP code search feature below to see if you're eligible for the My Medical Neighborhood Plan in 2023.

Plan Overview

- NO REFERRALS- Choose the doctors you want to see – no referral required to see a specialist.

- COPAY - $35 office visits, $25 Urgent Care visit, pharmacy-refer to pharmacy chart

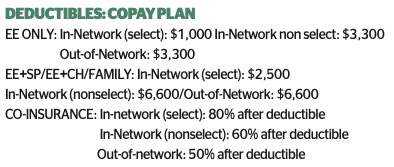

- DEDUCTIBLE -With the Copay plan, you pay 100% of your health care expenses until you meet your annual deductible, excluding office visits. See deductible amounts below.

- COST SHARING - After meeting your annual deductible, you share the cost of health care expenses by paying co-insurance (a percentage of the total cost).

- PREVENTIVE CARE - In-network routine preventive care and qualifying preventive prescriptions are covered at 100%.

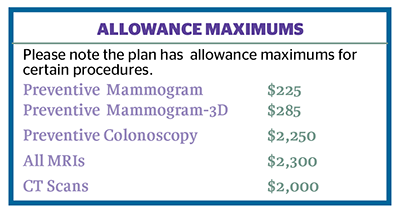

- ALLOWANCE MAXIMUMS - Note that there are allowance maximums for preventive mammogram ($225), preventive mammogram-3D ($285), preventive colonoscopies ($2,250), all MRIs ($2,300 after deductible is met), and CT Scans ($2,000 after deductible is met). See details.

- OUT-OF-POCKET MAXIMUM ALLOWANCE - The most a plan member will pay per year for covered health expenses before the plan pays 100% of covered health expenses for the rest of that year.

> In-Network - Employee Only - $6,000; Family - $13,000

>Out of Network - Employee Only - none; Family - none - PRESCRIPTION - Qualifying Walmart prescriptions $4 List or $0 for certain generics, copay applies (see Pharmacy chart)

- MEDICARE - If you are covered under Medicare, you are eligible to participate in the Company Medical Plan, however, you are not eligible to own an HSA Account per IRS guidelines.

- HSA ELIGIBILITY - Per IRS rules, you must be enrolled in the Company's Medical Plan to have an HSA account; have no other health coverage; not be enrolled in Medicare; and cannot be claimed as a dependent on someone else's tax return.

- FSA ELIGIBILITY - You may participate in the healthcare FSA account if you enroll in the Copay Plan, age 65 and older and not enrolled in a high deductible health plan.

Medical Plan Details

My Medical Neighborhood with Cigna continues to be Mohawk’s health care plan for employees working at our Muskogee, OK facility. The Neighborhood consists of a select group of preferred providers in thirteen key fields of practice to create an easily accessible, close-knit group of providers for you and your family in these regions.

If you or your dependents seek healthcare outside the Neighborhood area, then Cigna OAP will apply to those healthcare expenses. As always, important preventative health care screenings and procedures are available at no cost to you. Please note in-network and out-of-network deductibles and out-of-pocket expenses are all separate and do not crossover. To find a provider and additional detail, visit mymohawkneighborhood.com.

My Medical Neighborhood - 13 Specialties

Out-of-Pocket-Max

EE Only: - In-Network - $6,000 | Out-of-Network - None

Family: - In-Network - $13,000 | Out-of-Network - None

Plan Rates

*For coverage, Spouse also refers to Common Law

![]() Premium Assistance Under Medicaid and the Children’s Health Insurance Program (CHIP)

Premium Assistance Under Medicaid and the Children’s Health Insurance Program (CHIP)

Medical Plan Surcharges

New enrollees to the company medical plan will be required to complete a biometric screening within 60 days of your benefit effective date to avoid a wellness surcharge. For additional details, visit the Biometrics and Health Coaching page.

Based on results, employees and/or covered spouses may be required to complete face-to-face, telephonic or online health coaching. Employees and covered spouses who choose not to work with a Healthy Life Team Navigator (HLN), do not make contact with their HLN or do not complete biometrics testing, will be charged an additional $28.85 per week or $125 per month as a surcharge on top of your medical plan premium.

If you enroll a spouse in the Company Medical Plan, they will be included in a spousal audit for other medical coverage. If your spouse’s employer offers insurance and you elect to cover him/her on Mohawk’s Medical Plan, you will pay an additional $125 per month in medical contributions.

*New hires and those new to the medical plan as a result of a Qualifying Life Event, please visit the Biometrics & Coaching page for details.

Surcharges:

The information below outlines ways in which medical surcharges will be applied. Keep in mind, the maximum surcharge is $57.70 per week or $250 per month in addition to your Medical plan contribution.

- $28.85/wk or $125/mo: If covered Employee does not complete a Biometric Screening when notified.

- $28.85/wk or $125/mo: If covered Spouse* does not complete a Biometric Screening when notified.

- $28.85/wk or $125/mo: If covered Employee requires Coaching based on biometric screening results and refuses to work with a health coach.

- $28.85/wk or $125/mo: If covered Spouse* requires Coaching based on biometric screening results and refuses to work with a health coach.

- $28.85/wk or $125/mo: If Spouse* enrolls in the Mohawk Medical plan and has access to other group medical coverage through their employer.

*For coverage, Spouse also refers to Common Law

Links and Additional Information

![]() My Medical Neighborhood Copay Plan Summary Plan Description

My Medical Neighborhood Copay Plan Summary Plan Description

![]() My Medical Neighborhood Copay Plan SBC

My Medical Neighborhood Copay Plan SBC

![]() Summary of Material Modification-VIVIO Specialty Medications Program

Summary of Material Modification-VIVIO Specialty Medications Program

![]() Approved Cigna Flu Shot Providers

Approved Cigna Flu Shot Providers

![]() Preventive Health Coverage Guide

Preventive Health Coverage Guide

![]() Eligible and Ineligible Expenses

Eligible and Ineligible Expenses

Contact the Benefits Service Center or Cigna

For questions about your benefits including claims, eligibility, or to order an ID card contact

Benefits Service Center | 1-866-481-4922 OR

Cigna | 1-855-566-4295 | www.mycigna.com

Important Notes:

- In Ala., Calif., and N.J., contributions are prior to federal taxes but after state income taxes. Employer contribution, earned interest and investment income are all taxable as gross income for state income tax purposes.